Achieve higher returns with our suite of proprietary alpha-generating analytics and models, grounded in sound economic intuition and backed by rigorous analysis.

The full suite of analytics and models

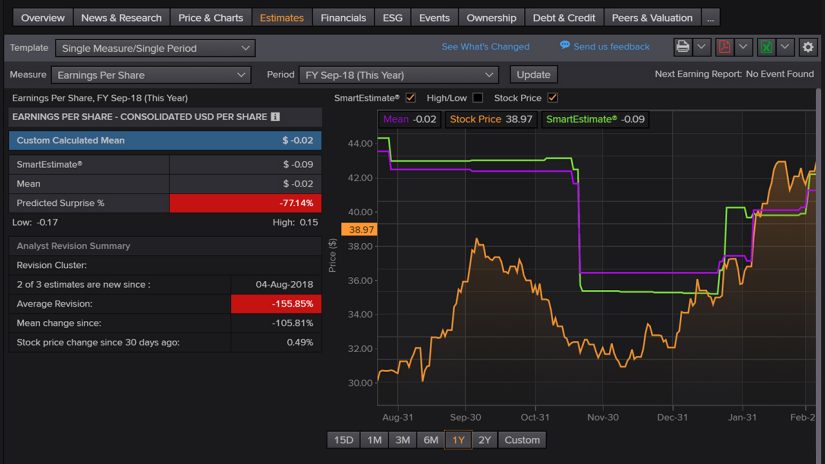

StarMine Analytics

Base decisions on more accurate estimates. SmartEstimates are weighted towards top analysts’ recent forecasts, helping you anticipate directionally correct earnings surprises. Revenue SmartEstimates deliver a 78% directionally correct surprise accuracy figure. SmartEconomics outperform a simple consensus forecast for macroeconomic data accuracy.

Analytics that are more accurate than consensus earnings and macroeconomics forecasts

StarMine M&A Arbitrage Spread

The StarMine Arbitrage Spread data feed tracks the progress of mergers and acquisitions throughout the course of a transaction. The analytic provides insight into competitive positioning and merger arbitrage strategies. By analysing the spread on a deal, analysts can understand the market’s belief about the potential for success of the transaction.

The analytic provides insight into competitive positioning and merger arbitrage strategies

Valuation, momentum, and earnings quality quantitative models

Use on a standalone basis or as an input into a multi-factor model. Adjust for over-optimistic growth forecasts caused by bias in analyst estimates and improve your forecast accuracy and stock ranking ability. Identify cheap stocks poised for rebound, as well as overpriced ones likely to revert. Predict the persistence of earnings, drawing on our quantitative multi-factor approach.

Use a range of Quantitative models to evaluate a company in Eikon

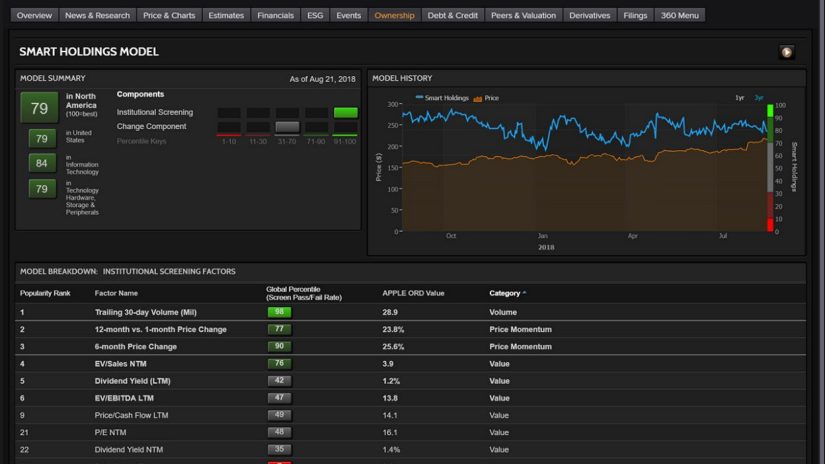

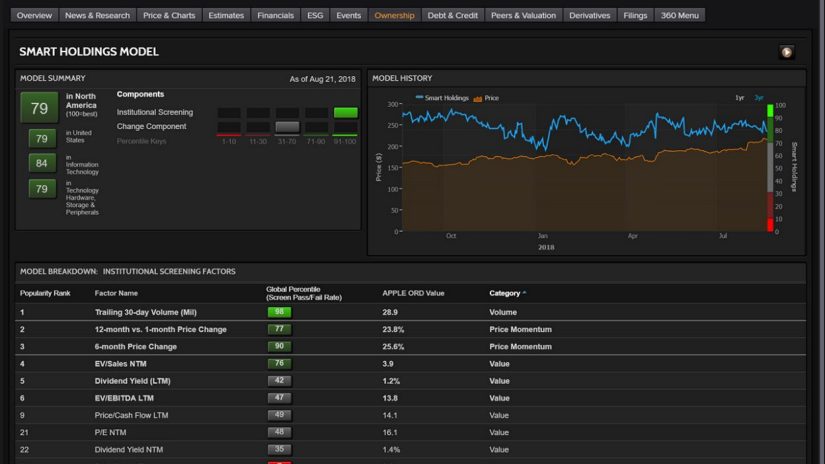

Smart Money models

Predict stock price changes by leveraging analysis from institutions, short sellers, corporate insiders, and beyond. StarMine Smart Money comprises our Short Interest and Smart Holdings Model, plus StarMine Insider Filings.

Provides insights from actions taken by financial institutions, short sellers, and corporate insiders

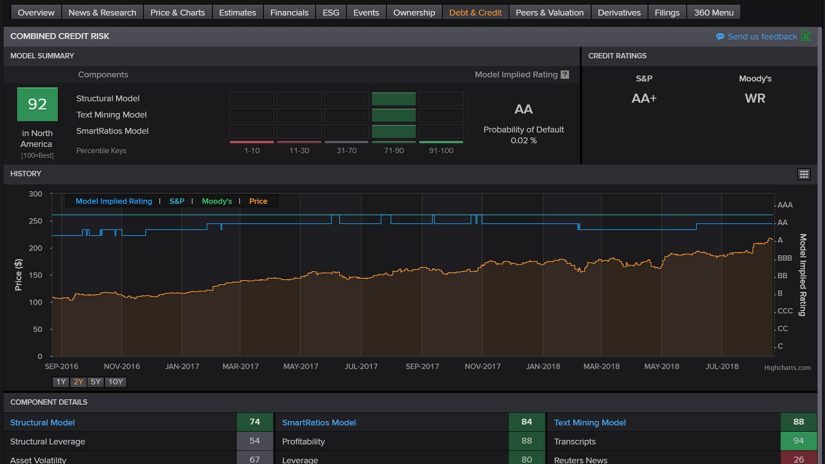

Credit and Sovereign Risk Models

Take a multi-pronged approach to predicting credit risk and default probability. StarMine draws on complementary sources of data and analytical methods so you can quantitatively assess and predict credit risk. Our unique Text Mining Credit Risk Model identifies language predictive of credit risk by applying sophisticated algorithms.

Quantitative assessment of credit risk and the probability of default

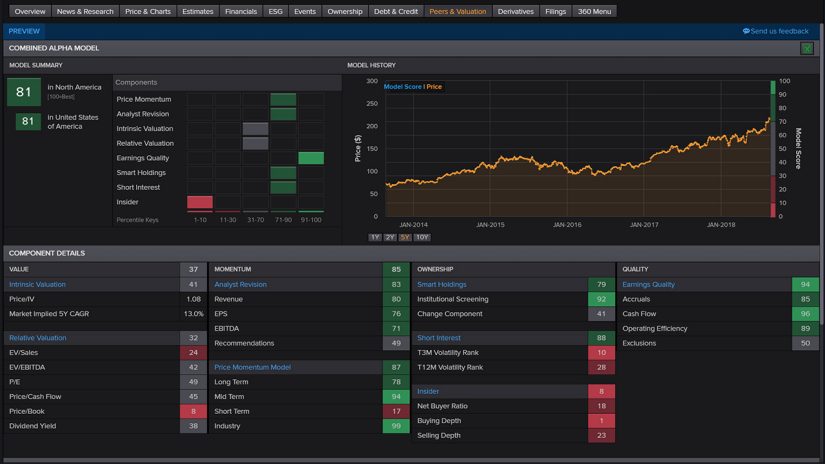

Combined Alpha Model

Simplify your stock selection process by using a simple, single score for a company. The Combined Alpha Model score is derived from the optimal combination of available value, momentum, ownership, and quality quantitative models.

Better predict the performance of thousands of companies

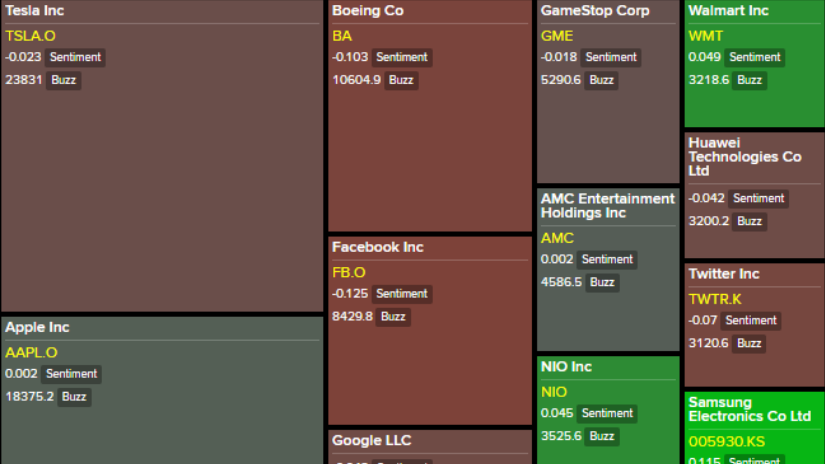

Media Sentiment Model

The StarMine MarketPsych Media Sentiment Model helps you predict the following month’s relative share price returns of U.S.-listed stocks. This is an equity returns model based on news and social media sentiment and complements fundamental models.

Visualization of StarMine MarketPsych Media Sentiment Model

Equity Data & Predictive Models

The Ford Equity Research products provide high-quality equities research data and predictive models to support multiple investment styles and objectives. Combining predictive models, proprietary measures, standardized ratios, and data makes these point-in-time historical databases well suited to performance testing, research modelling or strategy development.

Request details

Call your local sales team

Americas

All countries (toll free): +1 800 427 7570

Brazil: +55 11 47009629

Argentina: +54 11 53546700

Chile: +56 2 24838932

Mexico: +52 55 80005740

Colombia: +57 1 4419404

Europe, Middle East, Africa

Europe: +442045302020

Africa: +27 11 775 3188

Middle East & North Africa: 800035704182

Asia Pacific (Sub-Regional)

Australia & Pacific Islands: +612 8066 2494

China mainland: +86 10 6627 1095

Hong Kong & Macau: +852 3077 5499

India, Bangladesh, Nepal, Maldives & Sri Lanka:

+91 22 6180 7525

Indonesia: +622150960350

Japan: +813 6743 6515

Korea: +822 3478 4303

Malaysia & Brunei: +603 7 724 0502

New Zealand: +64 9913 6203

Philippines: 180 089 094 050 (Globe) or

180 014 410 639 (PLDT)

Singapore and all non-listed ASEAN Countries:

+65 6415 5484

Taiwan: +886 2 7734 4677

Thailand & Laos: +662 844 9576