Quickly identify credit opportunities and assess default risk

As central banks hike interest rates from record lows to combat inflation and markets experience volatility, it is more challenging than ever to analyse credit markets.

LSEG Workspace enables you to quickly identify and analyse credit opportunities, accurately assess default risk, and identify mispriced assets. Credit analysts can take advantage of our market-leading fixed income data and analytics including Yield Book, company fundamentals, and forward-looking credit risk models.

Useful Links

LSEG Workspace

Discover how we can upgrade your workflow.

Security Selection

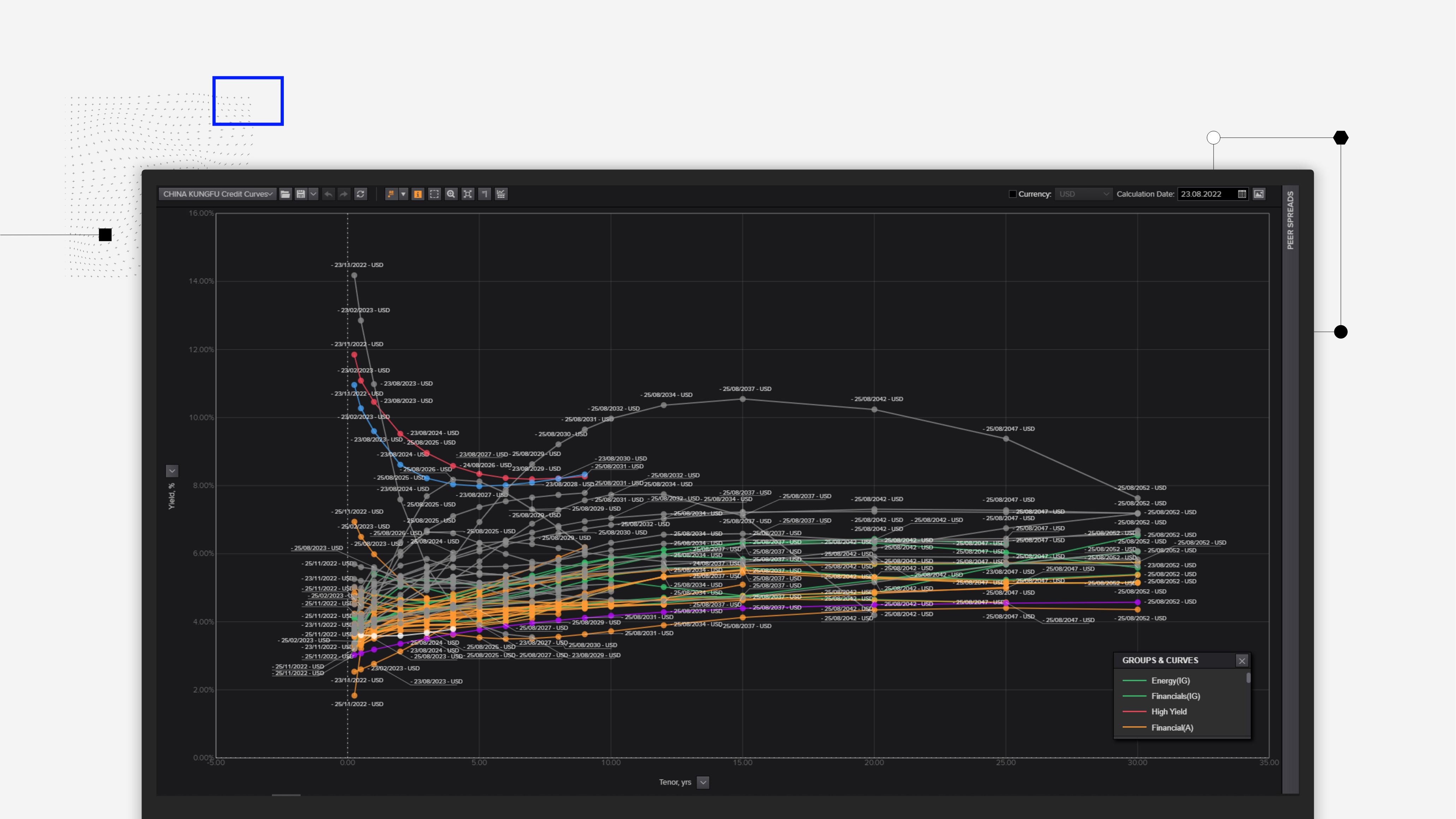

Find mispriced bonds more quickly.

Executing a strategy that outperforms means finding and analysing the best value bonds from the hundreds – or even thousands – of bonds for a given company or companies. Our Yield Map app on LSEG Workspace helps you find mispriced bonds and saves hours in yield curve fitting and relative value analysis.

Risk Mitigation

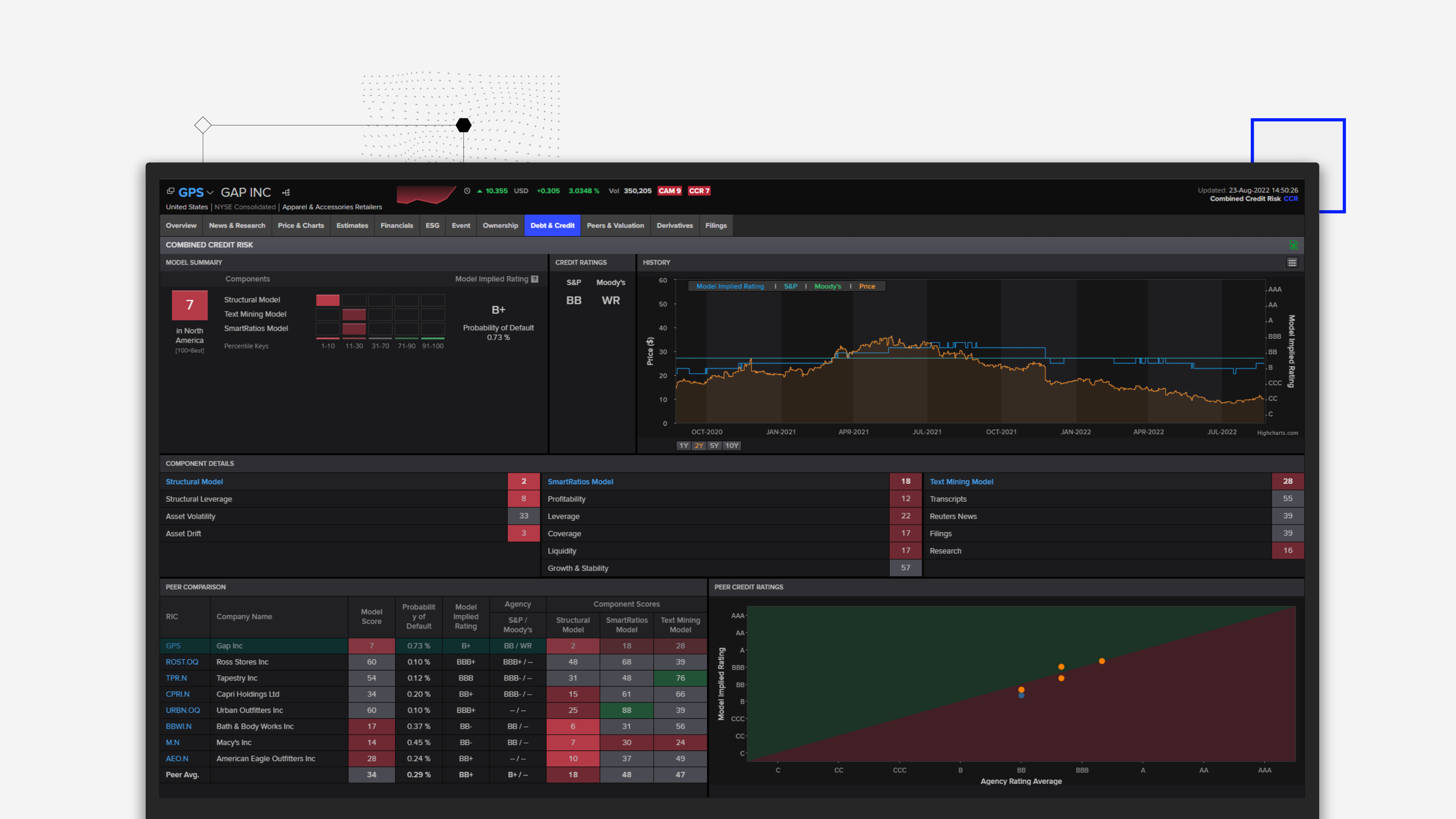

Spot deterioration of credit quality earlier with StarMine models.

Reduce risk in your credit portfolio with LSEG Workspace. Or, identify companies whose credit quality seems to be improving despite the economic backdrop.

Spot changes to credit quality before they are reflected in an upgrade or downgrade from the traditional credit rating agencies with StarMine Combined Credit Risk Model, published daily.

Security Analysis

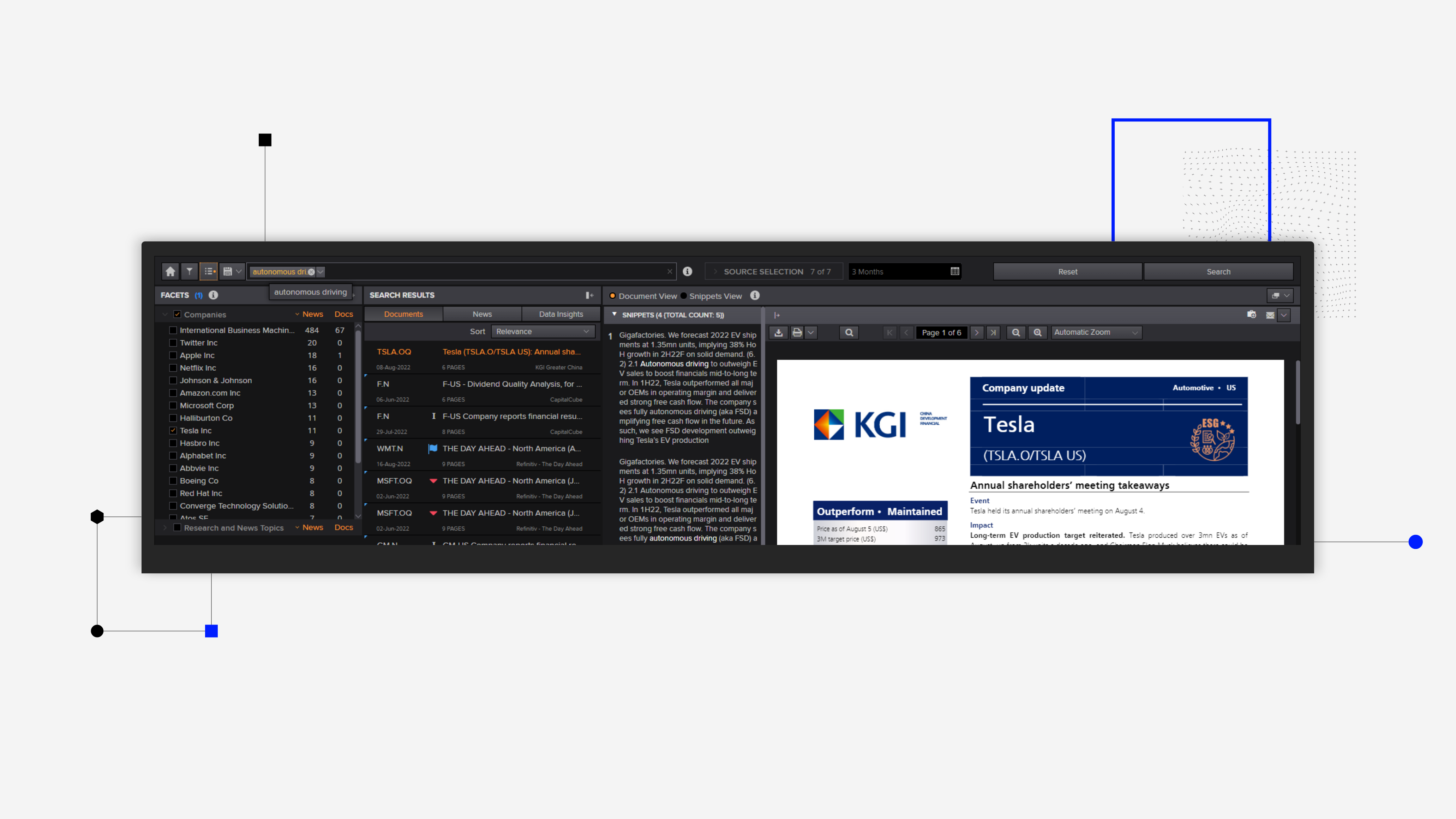

Speed up qualitative analysis of business quality and risk factors.

Instantly surface critical factors in evaluating a company, the factors impacting cashflows, and the competitive environment. LSEG Workspace Signal Search makes it easy to uncover risk factors related to the company or sector across research reports, news, transcripts, and filings.

Reduce the time it takes to review an earnings transcript from hours to minutes with our innovative SentiMine natural language processing – and immediately find themes and snippets relevant to credit quality (e.g. Competition, Revenue, Economic Slowdown).

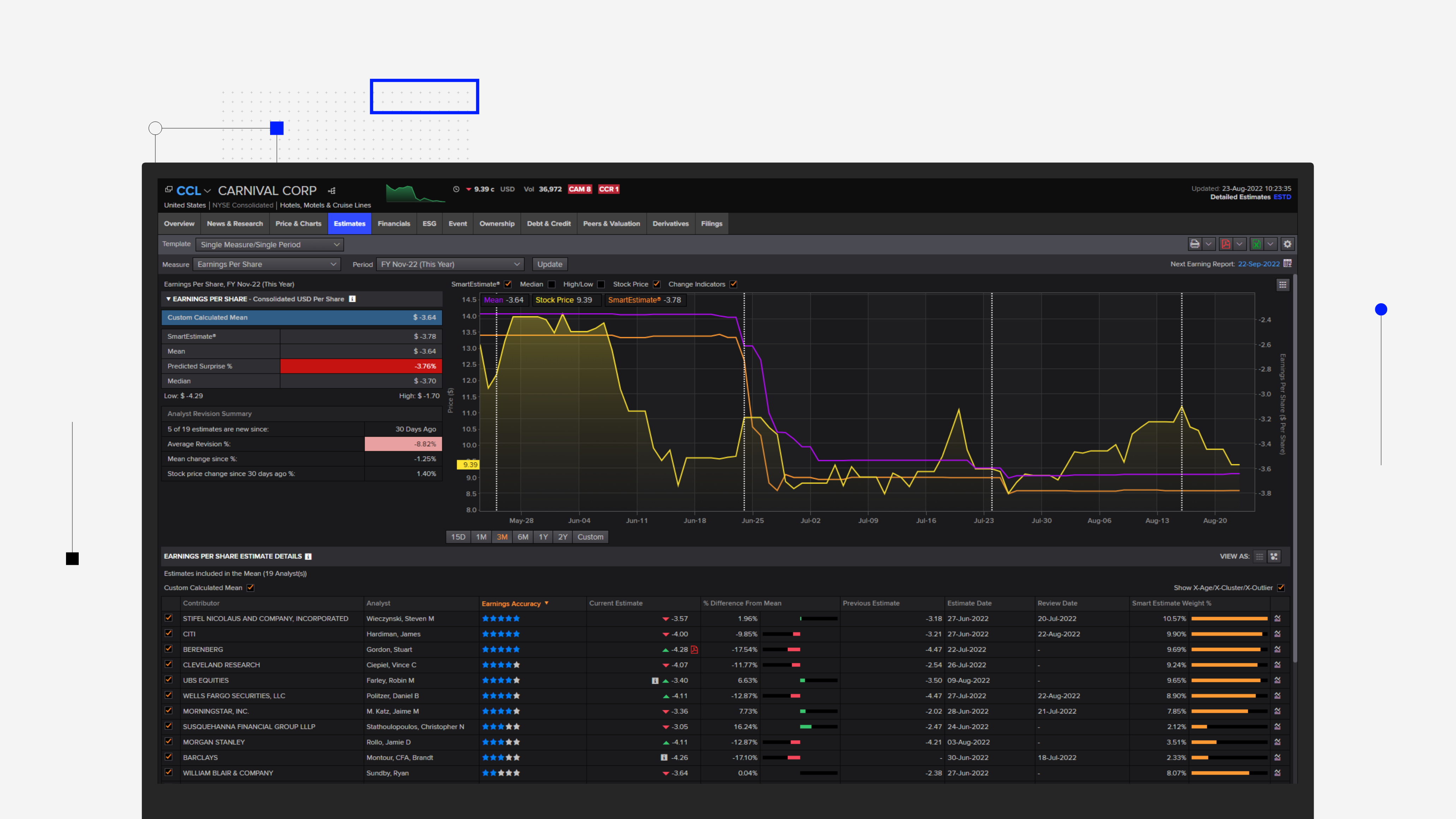

Get an edge with I/B/E/S Estimates and StarMine predictive analytics.

Assess a company’s financials and prospects with the combination of LSEG Fundamentals, I/B/E/S Estimates and StarMine predictive analytics. StarMine’s SmartEstimates are proven to be a more accurate predictor of future earnings surprises than traditional mean estimates. The patented model is simple but effective – overweighting those analysts with strong track records and more recent contributions.

Market and Portfolio Monitoring

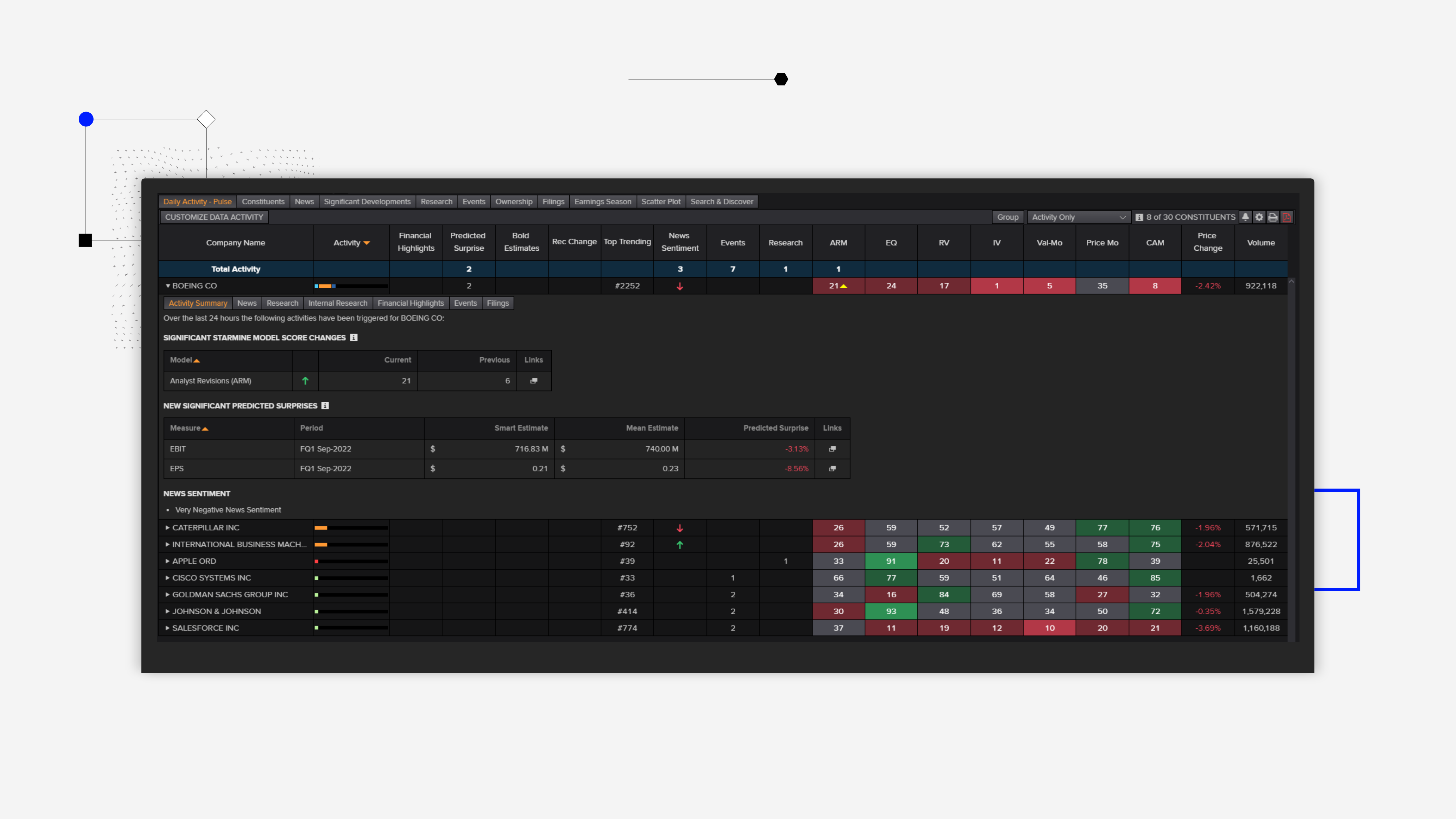

No noise, just new information that is critical to your portfolio.

Find out when there are developments that impact a company you are covering. Watchlist Pulse works for you 24x7, letting you know when there’s activity across news including Reuters, Upcoming Events, credit ratings, new broker research reports, new corporate filings, or StarMine proprietary credit models.

For example, track our unique StarMine Text Mining Credit Risk Model, providing an early indication of changing business conditions by evaluating the language in news, conference call transcripts, and filings.

Request product details

Call your local sales team

Americas

All countries (toll free): +1 800 427 7570

Brazil: +55 11 47009629

Argentina: +54 11 53546700

Chile: +56 2 24838932

Mexico: +52 55 80005740

Colombia: +57 1 4419404

Europe, Middle East, Africa

Europe: +442045302020

Africa: +27 11 775 3188

Middle East & North Africa: 800035704182

Asia Pacific (Sub-Regional)

Australia & Pacific Islands: +612 8066 2494

China mainland: +86 10 6627 1095

Hong Kong & Macau: +852 3077 5499

India, Bangladesh, Nepal, Maldives & Sri Lanka:

+91 22 6180 7525

Indonesia: +622150960350

Japan: +813 6743 6515

Korea: +822 3478 4303

Malaysia & Brunei: +603 7 724 0502

New Zealand: +64 9913 6203

Philippines: 180 089 094 050 (Globe) or

180 014 410 639 (PLDT)

Singapore and all non-listed ASEAN Countries:

+65 6415 5484

Taiwan: +886 2 7734 4677

Thailand & Laos: +662 844 9576