Advanced corporate treasury workflow tool

LSEG Corporate Treasury Risk

In partnership with Finmechanics, a leading provider of enterprise risk management systems, LSEG has enriched its desktop platform with a cross-asset treasury and risk service delivered over the cloud.

Powered by the Finmechanics proprietary risk platform, which incorporates best-in-class processes and technologies, LSEG workspace now integrates a specialist corporate treasury workflow tool that supports cash flow and liquidity forecasting, PnL and risk reporting, OTC derivatives pricing, and supports compliance activities such as hedge effectiveness reporting, margining, and credit valuation adjustment.

LSEG's unrivalled real and near-time cross-asset pricing and market data coverage, along with our world-leading reference, regulatory, corporate, and economic data resources, as well as the LSEG’s market infrastructure and security expertise, combine to deliver a unique and powerful solution suite.

Features & benefits

Take control with LSEG Corporate Treasury Risk

Precisely aggregated cash and security ladders. Cash flow forecasts, cash pools, risk ladders and position management.

Forecasting and analysis bring corporate treasurers to the heart of strategic business decision making, with the ability to report at both group level and individual entity level.

Access MtM, P&L, CVA and Risk reports on all assets. Leverage asset/liability analysis, forward accrual and funding cost analysis.

Product in action

See LSEG Corporate Treasury Risk in action

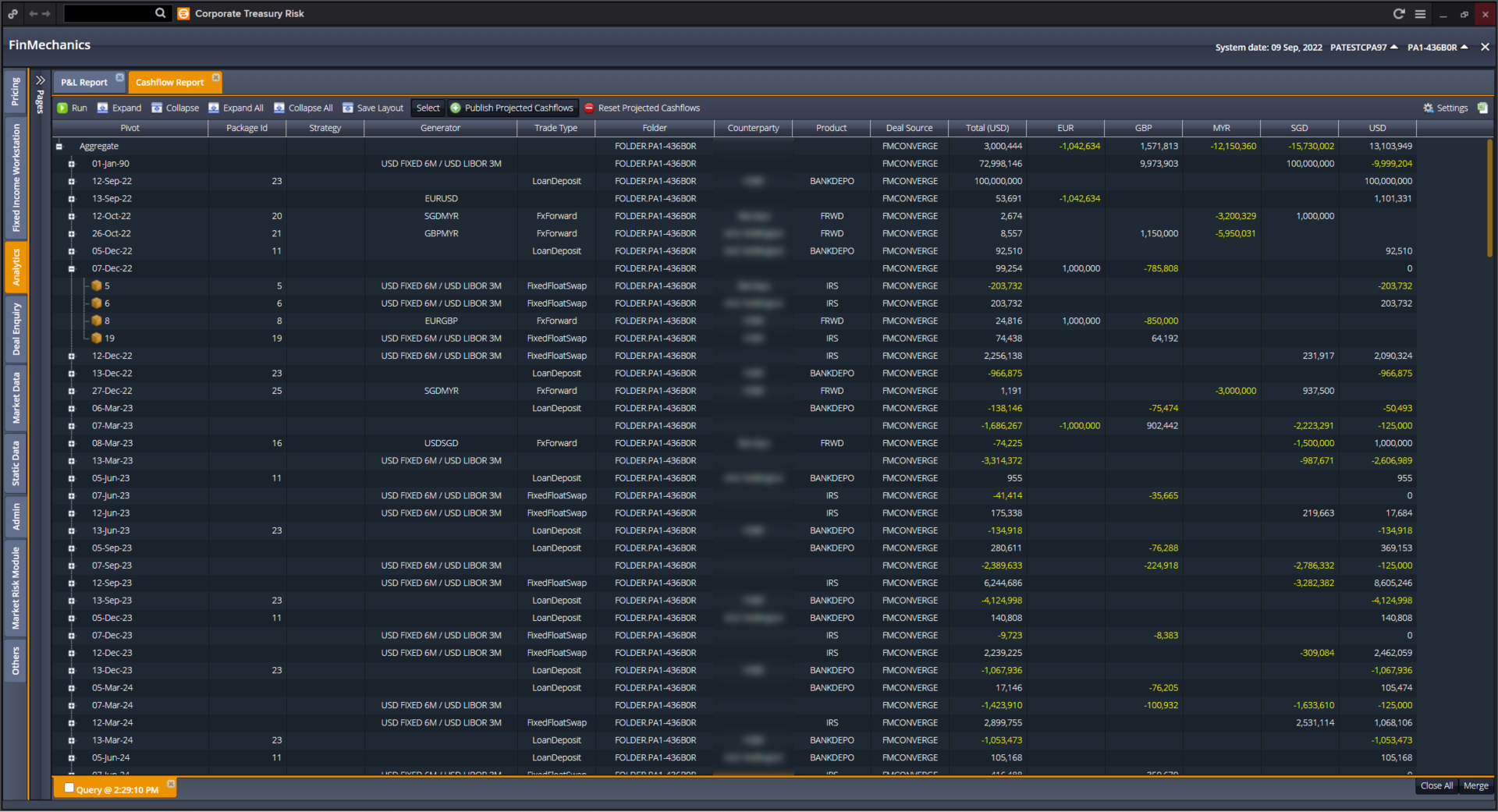

Generate on-demand cash flow reports for your portfolio of deals

- Monitor liquidity/cash flow positions for your portfolios across different currencies and asset classes or products

- Aggregation and Drill-Down capability for cash flows based on different criteria such as portfolio, trade type, deal id, etc.

- Analyse forecasted cash flows for projection analysis

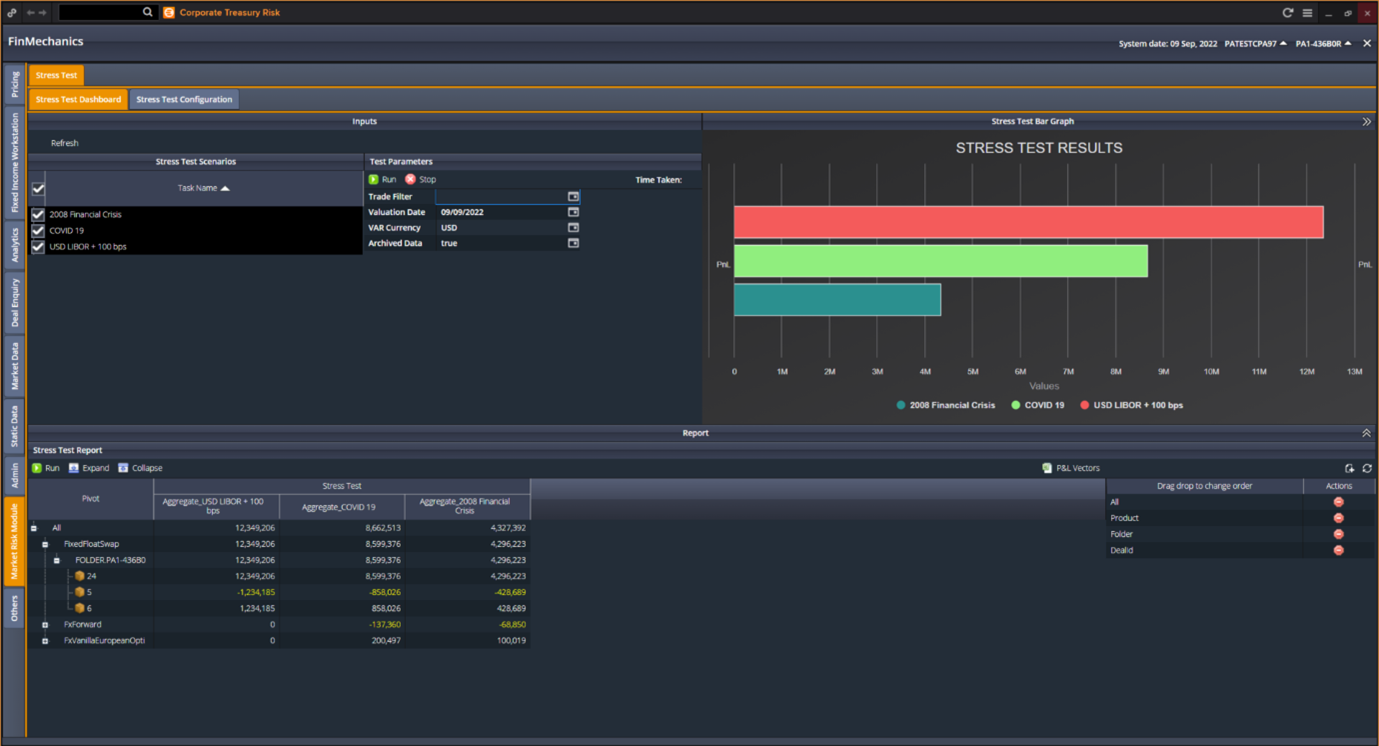

Stress test with scenario analysis capabilities

- Create scenario configurations to simulate market data movements and analyse P&L under those scenarios, for example declining/rising interest rates, flattening yield curve, etc. or specific historical real-world scenarios such 2008 financial crisis, etc.

- Compare & Drill-Down into portfolio P&L across scenario configurations to analyse how assets/liabilities perform under various stress scenarios

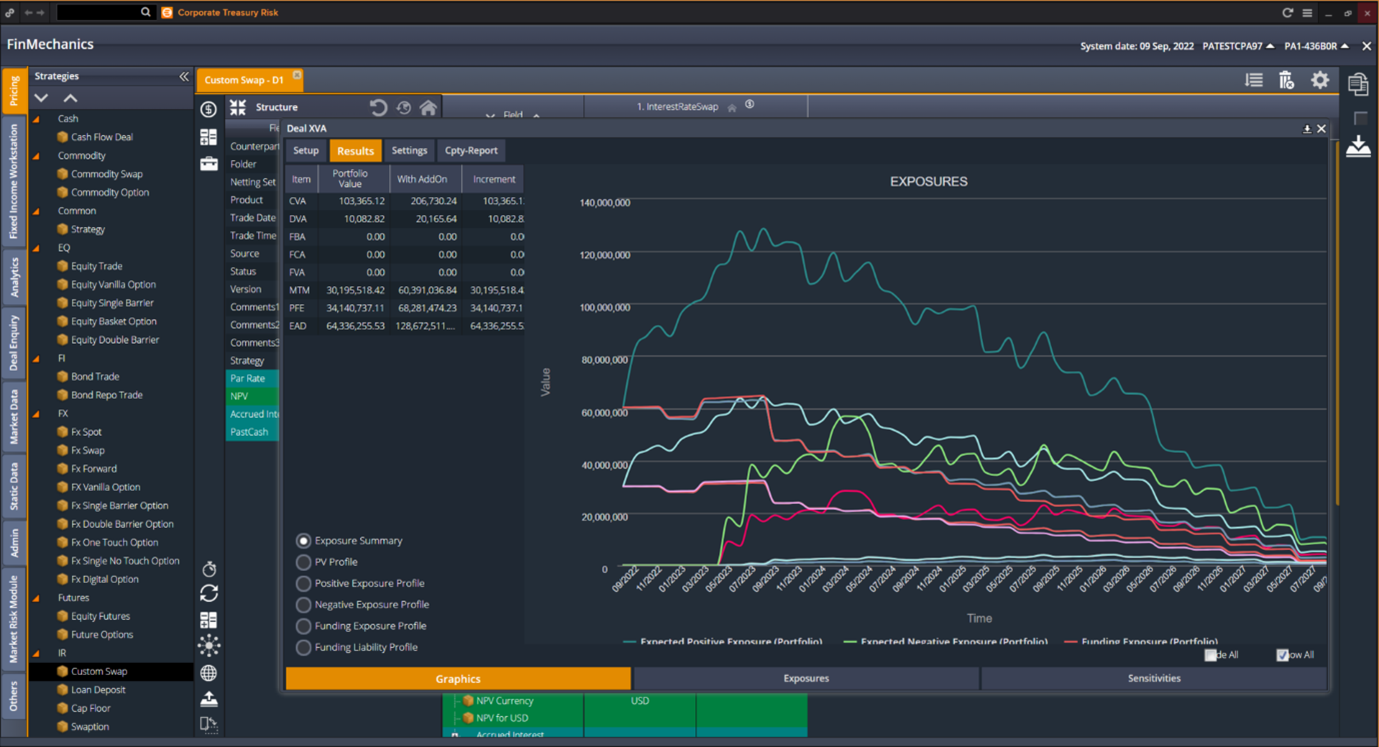

Easily calculate pre-deal credit valuation adjustment (CVA) figures

- Pre-Deal CVA exposure calculation to determine incremental CVA contribution of a new deal to optimise trading decisions

- High performance Monte Carlo engine supports calculation of counterparty credit risk exposures such as PFE, EPE, etc.

- Drill-Down into exposure calculations for Monte Carlo paths with a full transparency into calculations

- Ability to define CSA terms and incorporate collateral and netting agreements into calculations

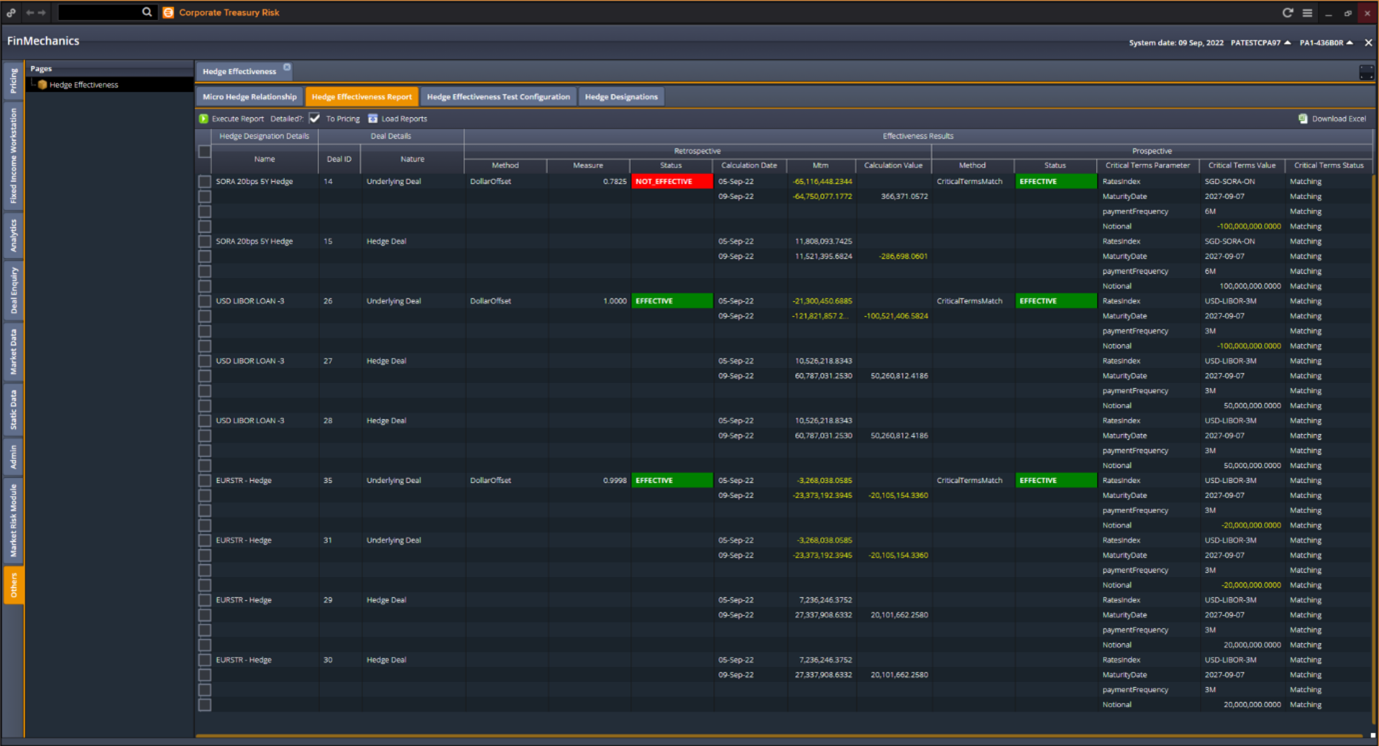

Determine hedge effectiveness

- Comprehensive coverage of both prospective and retrospective methodologies for hedge effectiveness testing including critical terms match, dollar offset method, regression analysis, etc.

- Hedge Designation capability to allow tagging of underlying and hedge deals

- Hedge effectiveness reporting functionality to show effectiveness results across various hedge designated deals and effectiveness configurations

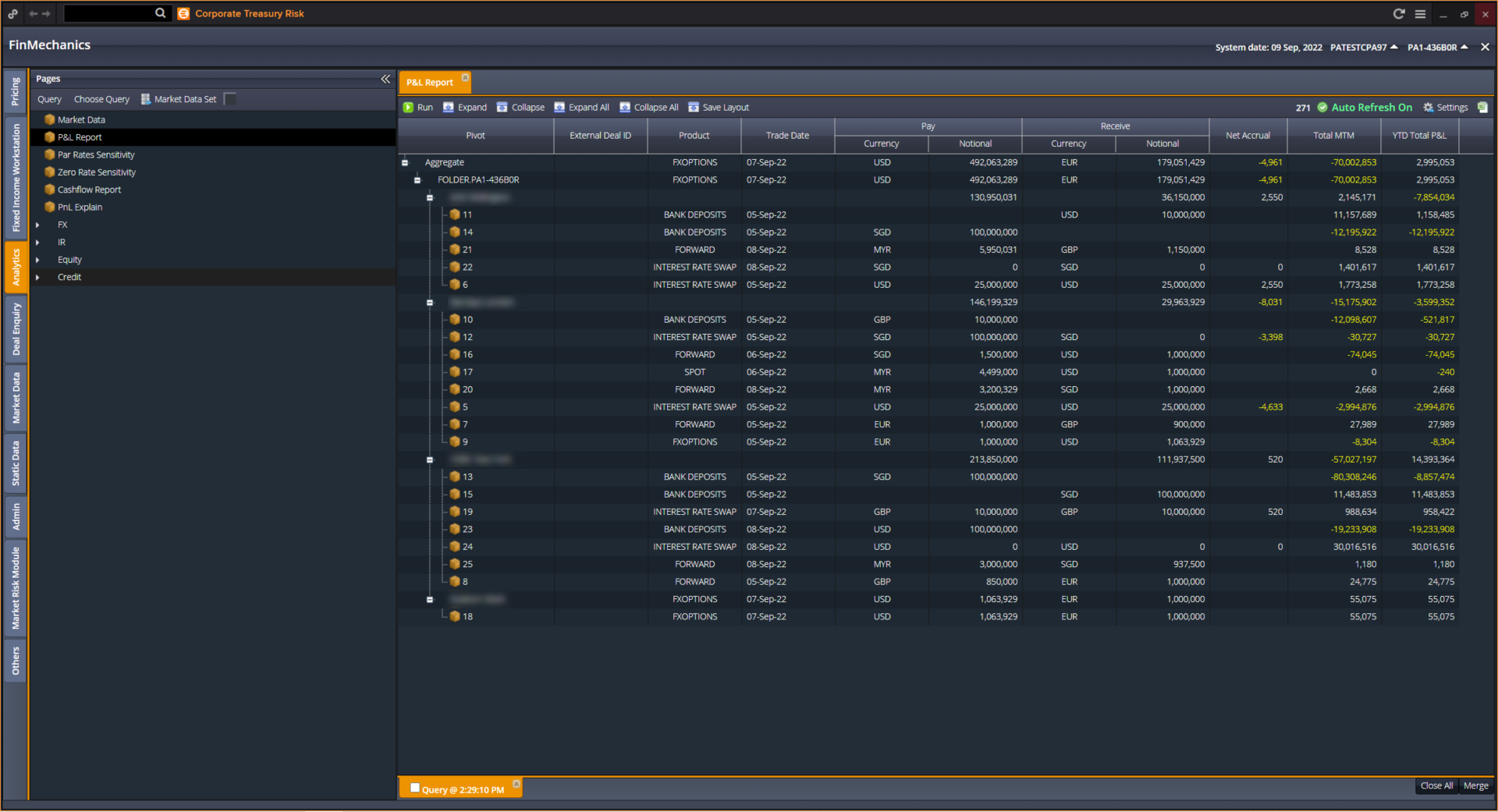

Benefit from simple P&L reporting functionality

- Cross-Asset Report to calculate Mark-to-Market for the full portfolio of trades based on latest market data inputs

- Configure and re-design of report layouts with a capability to slice and dice the data as desired for specific report requirements

Request details

Call your local sales team

Americas

All countries (toll free): +1 800 427 7570

Brazil: +55 11 47009629

Argentina: +54 11 53546700

Chile: +56 2 24838932

Mexico: +52 55 80005740

Colombia: +57 1 4419404

Europe, Middle East, Africa

Europe: +442045302020

Africa: +27 11 775 3188

Middle East & North Africa: 800035704182

Asia Pacific (Sub-Regional)

Australia & Pacific Islands: +612 8066 2494

China mainland: +86 10 6627 1095

Hong Kong & Macau: +852 3077 5499

India, Bangladesh, Nepal, Maldives & Sri Lanka:

+91 22 6180 7525

Indonesia: +622150960350

Japan: +813 6743 6515

Korea: +822 3478 4303

Malaysia & Brunei: +603 7 724 0502

New Zealand: +64 9913 6203

Philippines: 180 089 094 050 (Globe) or

180 014 410 639 (PLDT)

Singapore and all non-listed ASEAN Countries:

+65 6415 5484

Taiwan: +886 2 7734 4677

Thailand & Laos: +662 844 9576