LSEG Workspace for central banks

Experience our next-generation, end-to-end workflow solution tailored for central banks.

LSEG Workspace provides a highly customised experience built for your unique workflow needs - enabling you to operate with confidence at every stage of the financial market ecosystem.

Advancing with a unique and customised workflow solution

As central banks face increasing pressure to manage risk and navigate a rapidly evolving financial landscape, Workspace equips you with the information and analytics you need to succeed.

Offering you a fully automated workflow solution across debt issuance and liquidity management, Workspace is built to enhance operational efficiencies and increase market transparency.

Comprehensive market insight

Always available, wherever you are.

Workspace interconnects data, analytics, trading workflow and liquidity via various native workflow tools, leveraging the underlying smart technology and native APIs. Used with Auctions, Matching, FXall and Conversational Dealing, Workspace delivers a comprehensive, experience fully automated workflow across the debt issuance, liquidity management, price discovery and execution processes.

Manage market liquidity effectively with the Auctions app that enables FX, FX swaps, NDFs, term deposits, securities issue or reissue, buyback, repo or reverse repo transactions.

Commingle unique primary market non-last-look liquidity from Matching and EBS in a single view for FX price discovery to understand market impact better. And leverage FXall volume tiered reference rates to inform your execution decisions.

Access award-winning Reuters News with 10,000 other sources and real-time broker research available from 1,300 sources. Leverage trusted insights from Reuters Breakingviews, FX Buzz and IFR market commentary, plus trade recommendations from our global team of over 20 analysts.

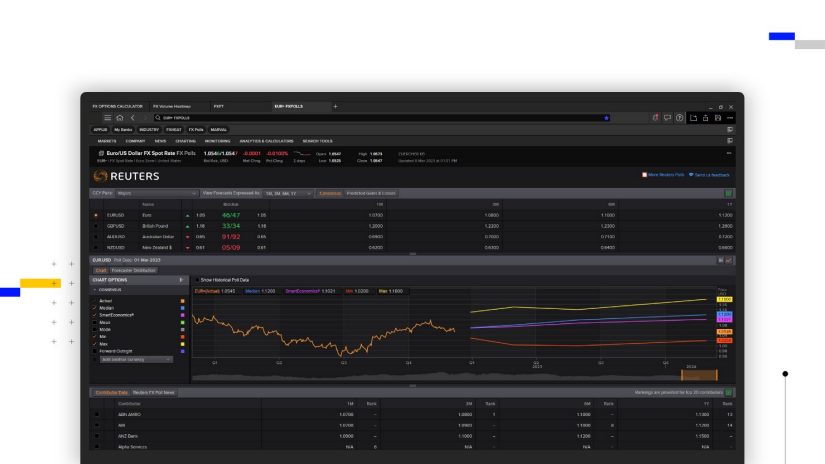

Access interest rate probability for 20 central banks, Reuters Polls for economic indicators, FX, money markets and rates consensus estimates, plus streaming data from Tradeweb, MarketAxess and Markit CDS.

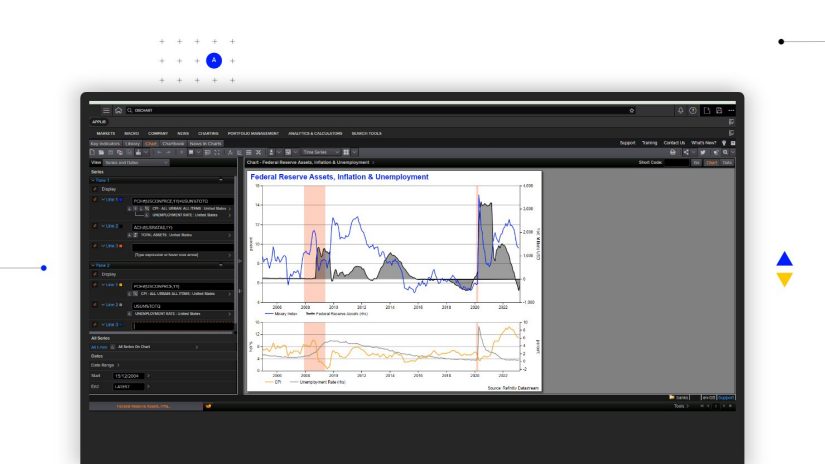

Perform deeper analysis and validate trading ideas with market-leading content and intuitive charting capabilities from Datastream, the world’s most comprehensive financial time-series database. Collaboration tools and add-ins for Microsoft Office will help simplify your workflow.

Features & Benefits

What you get with LSEG Workspace for central banks

Tools to perform the auction operation from start to finish

LSEG Auctions has supported on average $2.8 trillion of auctions volume every year for the last four years, with just over $4 trillion auctioned in 2022.

Manage your entire auction workflow from announcement to results publication with Auctions app

Advanced charting capabilities

Access an unrivalled range of cross-asset content, unique features and analytics tools to help you understand how markets are interacting when you explore over 120 years of data from Datastream, the largest global financial time-series database.

Datastream helps you explore trends, generate and test investment and trading ideas, and develop market viewpoints.

Unique market monitoring content

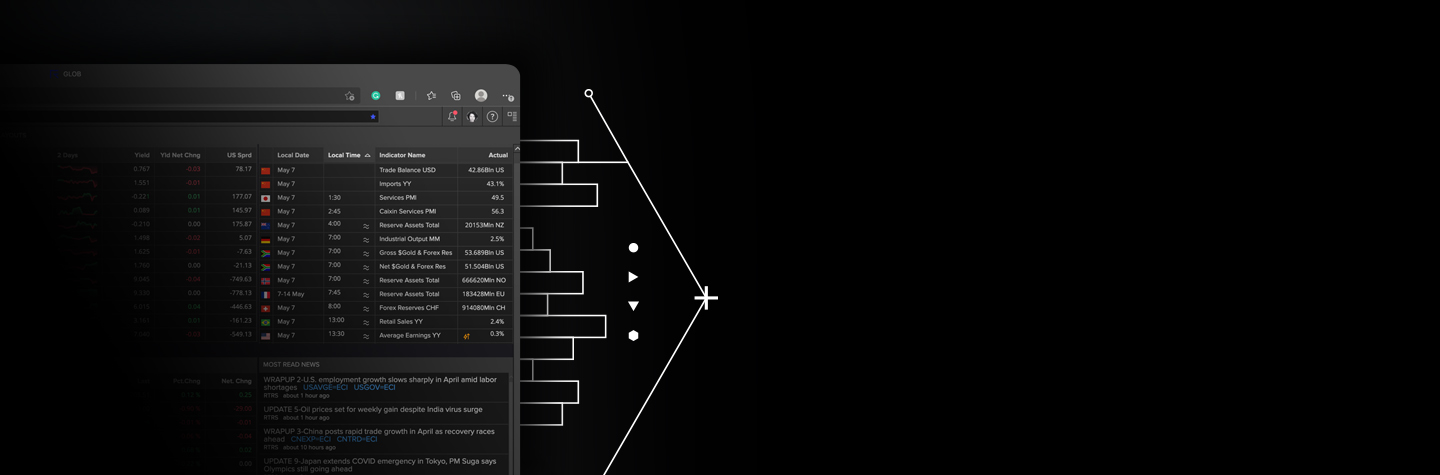

Economic Monitor delivers real-time coverage of key central bank and economic indicators along with Reuters Polls consensus forecasts from and StarMine SmartEconomics predictive analytics.

See reliable consensus forecasts and historical analysis with Reuters polls, including FX and central bank polls.

Request product details

Call your local sales team

Americas

All countries (toll free): +1 800 427 7570

Brazil: +55 11 47009629

Argentina: +54 11 53546700

Chile: +56 2 24838932

Mexico: +52 55 80005740

Colombia: +57 1 4419404

Europe, Middle East, Africa

Europe: +442045302020

Africa: +27 11 775 3188

Middle East & North Africa: 800035704182

Asia Pacific (Sub-Regional)

Australia & Pacific Islands: +612 8066 2494

China mainland: +86 10 6627 1095

Hong Kong & Macau: +852 3077 5499

India, Bangladesh, Nepal, Maldives & Sri Lanka:

+91 22 6180 7525

Indonesia: +622150960350

Japan: +813 6743 6515

Korea: +822 3478 4303

Malaysia & Brunei: +603 7 724 0502

New Zealand: +64 9913 6203

Philippines: 180 089 094 050 (Globe) or

180 014 410 639 (PLDT)

Singapore and all non-listed ASEAN Countries:

+65 6415 5484

Taiwan: +886 2 7734 4677

Thailand & Laos: +662 844 9576